“In the next hour, you will make two hundred cash. But you will have to do something illegal. You won’t be in danger, but you will be breaking the law.” With that statement, Emily found herself introduced to organized retail crime.

Netflix’s Emily the Criminal tells the tale of how protagonist, Emily, played by Aubrey Plaza, falls into the illegal thrills and fast money of black-market capitalism, better known as organized retail crime (ORC). Emily, desperate to pay off her student loans, dives headfirst into the world of credit card fraud using stolen credit cards to purchase goods and then sell them for profit.

68% of retail respondents surveyed experienced higher rates of in-store fraud in recent years.

Emily’s victims—retailers—know this story all too well. Organized retail crime is on the rise both in-store and online. According to the 2022 National Retail Security Survey, 68% of retail respondents surveyed experienced higher rates of in-store fraud in recent years, while 61% indicated a rise in ecommerce fraud. It’s easy to imagine that movies like Emily the Criminal might further encourage fraudsters wanting to make some cash.

With the surge in ORC, retailers often struggle to know where to start their defense. Luckily for retailers, software tools using artificial intelligence and machine learning are available to help stop fraud, doing the work that would be impossible for humans. By understanding the scope of ORC, retailers can invest in the right tools to protect themselves.

Trends and challenges of organized retail crime (ORC)

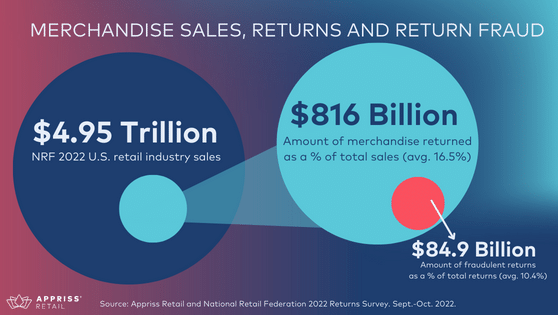

When dealing with organized retail crime, retailers are up against a lot. It is not as simple as credit card fraud like in the movie. ORC can include cybercrimes, internal theft, gift card and loyalty program fraud, returns fraud, claims, and payments fraud. And what’s more, in the 2022 National Retail Security Report, retailers detailed an increase in risk and threat priorities for all these types of fraud over the past five years. In particular, the expectation of fraud at the point of return, even when a receipt is present, jumped 4.3% year-over-year, from 9.8% in 2021 to 14% in 2022 according to the latest Consumer Returns in the Retail Industry Report published by NRF and Appriss® Retail.

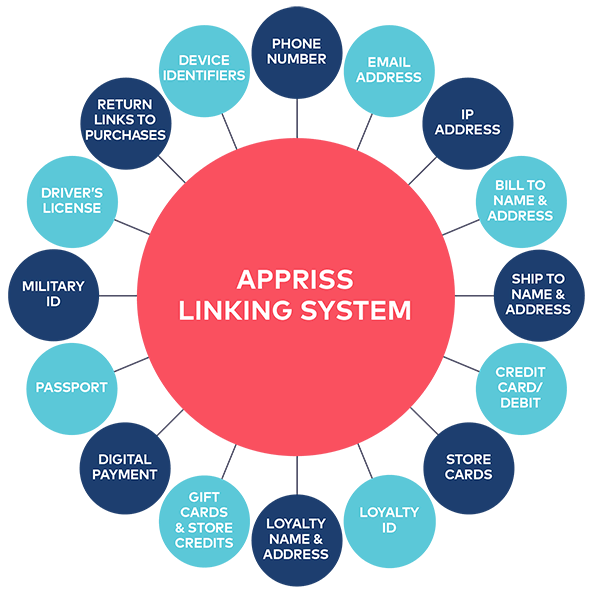

For many retailers, reducing fraudulent returns is an effective first step toward minimizing the impact of ORC. Yet, when fraudsters, like Emily, change aspects of their identity to successfully make repeated fraudulent purchases or returns, it’s nearly impossible for retailers to detect a pattern. The characters in the movie do not shop at the same store within the same week to avoid detection. Likewise, ecommerce consumers will deliberately change their email address, bill-to address, ship-to address, phone number, IP address, etc. to avoid detection.

Organized retail crime does not have to be a cost of doing business.

Fortunately, technology like Appriss Retail’s Engage product helps retailers analyze their transaction data in real time to link seemingly disparate transactions, identify potential fraud, and make informed decisions on whether to allow or deny a return. Retailers can say goodbye to one-size-fits-all returns policies that are designed to combat fraud but have the potential to alienate loyal consumers. Using artificial intelligence and machine learning to recognize the behaviors, patterns, and preferences of consumers, retailers can deliver a consistent experience during the final stage of a consumer’s journey while reducing risk and protecting profits.

The future of organized retail crime (ORC) fraud detection

Organized retail crime does not have to be a cost of doing business. Looking ahead, more retailers will rely on artificial intelligence and machine learning to guide them toward a more efficient, effective, and profitable retail experience.

Emily the Criminal would tell a different story if the fictional retailers used artificial intelligence and machine learning to fight fraud. But to find out what happened to Emily (the Criminal), you’ll have to watch the movie yourself.