CFOs approve larger budgets when loss prevention shifts from departmental shrink metrics to organization-wide revenue protection.

Pedro Ramos managed $2.5B in supermarket operations during his 23-year tenure as Assistant Vice President of Loss Prevention at Pathmark Stores, a Northeastern supermarket chain. He knows exactly what happens in those EOY budget meetings, where he’s watched six figures in expense requests shrink to double digits in available technology funding after operations and competitive store needs take priority.

Most loss prevention professionals walk into those meetings asking for shrink reduction tools. They present departmental metrics and compete with other divisions for limited resources, rather than making a case around total business impact.

Pedro instead opted to position solutions as business intelligence to protect revenue across multiple P&L lines and built direct relationships with business unit leaders to get buy-in on direction. From there, he met with the CFO and their business analyst, and structured implementations to deliver measurable results quickly without overwhelming IT resources.

That experience on the retailer side now shapes his approach to customer conversations as Appriss Retail’s Chief Revenue Officer. The retailers who secure comprehensive loss prevention investments are the ones who speak the language CFOs understand.

Key Takeaways:

- Returns reduce top-line sales dollar-for-dollar while forcing cash outflow to buy back used inventory, creating systematic margin erosion CFOs can immediately quantify

- Build direct CFO relationships and position solutions as revenue protection to secure faster approvals than those competing through departmental budget processes

- Siloed departments can’t see interconnected patterns, such as up to 80% of retail losses stemming from non-fraud sources like damaged goods, process breakdowns, and inventory errors

Why Your Shrink Metrics Don’t Get CFO Attention

Loss prevention teams often focus on departmental shrink reduction.

CFOs are more interested in allocating budgets based on revenue impact.

That disconnect explains why your business case gets pushed down to operations, while other initiatives secure executive sponsorship. While you’re solving for shrink percentages, the CFO is managing compressed margins, top-line sales pressure, and cash flow efficiency.

Pedro watched this play out repeatedly at Pathmark.

“CFOs are interested in anything that’s gonna drive top-line sales and expand margins,” Pedro explains. “They’re also interested in anything that doesn’t require additional headcount or processes.”

The conversation needs to start with business impact, not loss prevention metrics.

Every return reduces sales by an equal dollar amount. Retailers must also use cash from their bank account to buy back used inventory that now has quality issues from customer use.

Consider the apparel retailer who saw return rates drop 10% in the first 12 months after implementing a comprehensive solution. When they had to disconnect the system during a major system upgrade, return rates went back to previous levels within 90 days. As soon as they reconnected, rates dropped back down immediately.

That’s not shrink reduction. That’s revenue protection operating as a continuous control, similar to how every major company runs firewalls against external attacks. Shut off the firewall, and the attacks get through.

Building Your Business Case in ‘CFO Speak’

Securing CFO-level approval requires translating loss prevention metrics into financial impact statements. Pedro’s success at Pathmark came from treating budget conversations as business intelligence briefings rather than departmental requests.

These three tactics structure the business case that gets executive sponsorship.

Document cross-departmental financial impact using the metrics CFOs track daily

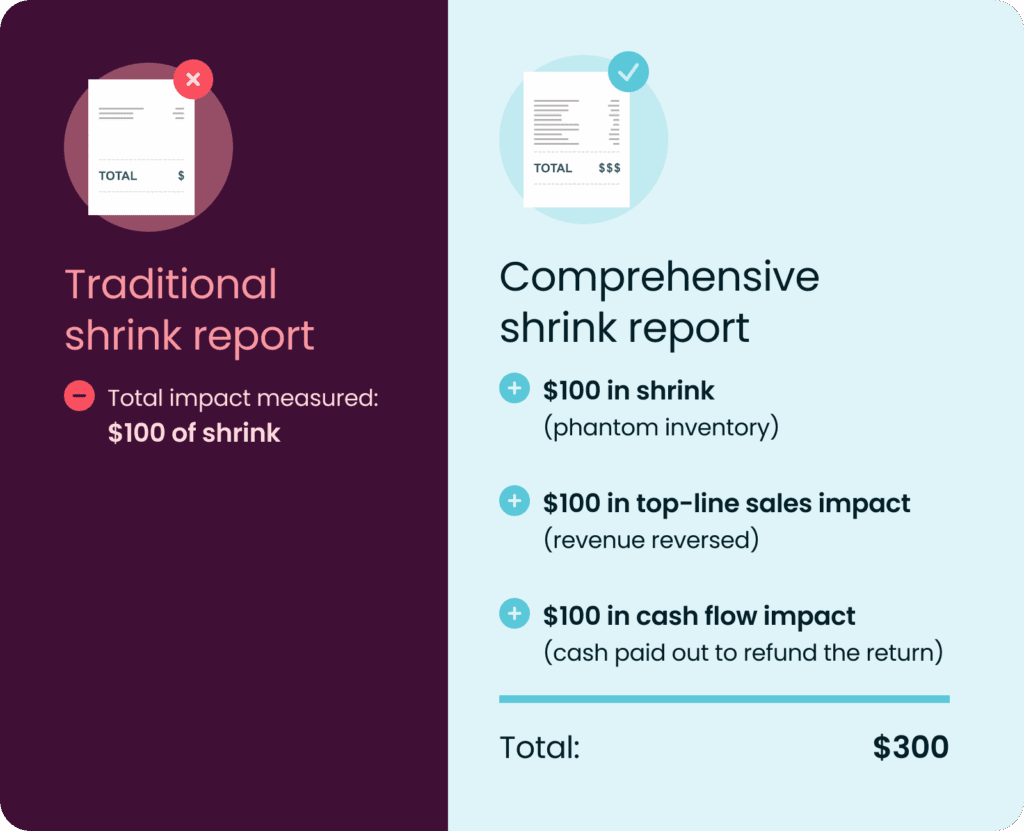

Start by quantifying total impact across all loss categories. Returns affect top-line sales, margins, and cash flow simultaneously. The same fraudulent behavior creates losses across multiple P&L lines, but departments managing those lines separately can’t identify the patterns.

Build comprehensive financial models showing how return fraud creates both shrink and cash flow problems. When someone uses a receipt repeatedly to return shoplifted items, they’re creating a 3-pronged problem:

- Creating phantom inventory (shrink)

- Reducing sales (top-line impact)

- Using the retailer’s store as an ATM to withdraw money from their bank account. (cash flow)

That triple impact matters more to a CFO than your shrink percentage.

Give status updates to your CFO (outside of budget meetings)

Pedro’s most successful budget conversations at Pathmark happened naturally during regular lunches with the CIO and the CFO’s business analyst. As the relationship grew, these discussions turned into business intelligence briefings about total retail loss trends affecting the organization, and how to collaboratively solve them.

Request direct meetings with the office of the CFO to present comprehensive business cases that include contributions for affected departments rather than solely going through normal departmental budget processes. Frame the conversation around total financial impact: margin compression, cash flow pressure, and revenue protection. This will help you position your solution as business intelligence, rather than a request for loss prevention technology.

The C-suite needs to understand that you’re providing visibility across departments to connect siloed initiatives, not just asking for another departmental tool.

Structure implementation to deliver CFO-visible results quickly

Pedro’s approach to budget allocation was straightforward:

→ Identify underperforming expenses in the operating budget (e.g., guard service allocation)

→ Adjust/optimize expenses to free up operating cash

→ Present the CFO with net-zero implementations requiring minimal additional capital.

Design phased rollouts that show measurable ROI quickly. For complex solutions start with the component that answers the problem at hand first and delivers proven results. Add additional components in a phased approach so as not to overwhelm IT.

Position the initial phase as self-funding through quick wins.

Three Loss Patterns CFOs Can Actually Measure

When presenting to CFOs, loss prevention professionals often overwhelm executives with complex fraud taxonomies and industry terminology. Pedro focuses on three core patterns to create clearer business cases, given that these categories can be measured and quantified for ROI discussions. We asked Pedro if he was buying a returns authorization solution to reduce returns and how he presents it.

- Return fraud happens when someone shoplifts items and returns them without receipts. This non-receipted fraud creates immediate shrink (inventory coming off shelves that was never sold), reduces top-line sales, and forces cash outflow.

- Multiple uses of the same receipt exploits systematic lags. Customers make online purchases, immediately cancel orders but keep receipts, then shoplift identical items from stores and return them using the cancelled order receipts. Because e-commerce and in-store systems don’t update in real time, this pattern repeats across multiple stores.

- Return Abuse occurs in many ways, excessive bracketing, wardrobing or taking advantage of liberal policies. For every dollar returned the impact of frictional costs and markdowns reduce the resale value of the product by over 50%. So when customers abuse all of the processes listed they become unprofitable.

This positioning gives you a concrete structure for CFO conversations. Focus on what can be measured and quantified rather than abstract concepts about fraud prevention.

Why Direct CFO Access Changes Everything

Building more direct relationships with Finance and the CFO gives you a few new advantages:

Faster approvals. When the CFO already understands your value proposition through regular business intelligence briefings, formal budget requests move through approvals quickly. You’re no longer introducing new concepts; you’re proposing a solution to problems they already recognize.

Comprehensive solutions instead of point tools. CFO backing helps you implement complete solutions that address interconnected loss patterns rather than fragmented departmental tools that miss how fraud multiplies across channels.

“In 2020, there was an explosion of new solutions to accommodate digital channels, and companies brought in dozens of new tools,” Pedro notes. “Today, businesses are more focused on redundancy and consolidation.”

Higher IT priority. Solutions receive priority IT resources when CFOs understand cross-departmental revenue protection value rather than single-department cost reduction.

You need executive sponsorship that elevates your solution above departmental competition for limited resources. That requires speaking the language CFOs use to evaluate all investments: revenue impact, margin expansion, and operational efficiency.

Find the underperforming expenses in your operating budget. Build your net-zero implementation proposal. Request that monthly business intelligence check-in. The conversation you need to have is about how you’re going to protect revenue across every line of the P&L.

Frequently Asked Questions

What is total retail loss?

Total retail loss (TRL) is a concept that involves calculating all points of loss within a retail enterprise. When analyzing “loss,” TRL goes beyond just calculating shrink to account for operational inefficiencies, damages, fuel mismanagement, inventory errors, and fraud—not just theft. Total retail loss prevention broadens the focus to managing all revenue drains across multiple departments, giving retailers the visibility and tools to tackle losses wherever they occur.

How do I get a meeting with the CFO when I report through operations?

Start by requesting time with the CFO’s business analyst to share insights about total retail loss trends affecting the organization. Position these as business intelligence briefings rather than budget requests. The analyst relationship often leads to direct CFO access once they recognize the cross-departmental value.

How do I help my CFO understand loss prevention?

Avoid loss prevention jargon entirely and instead talk about top-line sales impact, margin compression, and cash flow protection. Use the measurable loss patterns (non-receipted returns, receipt reuse, abusive bracketing) with clear dollar amounts rather than industry terminology.

Should I present total retail loss prevention as a technology investment or an operational improvement?

Present it as revenue protection that delivers business intelligence across departments. CFOs approve investments that drive measurable financial outcomes—top-line sales protection, margin expansion, and operational efficiency—not technology implementations or departmental tools.