Fraud in the retail industry is a growing concern, in part because bad actors have become increasingly sophisticated. In the era of online shopping, fraud can occur at any stage of the customer journey, making it difficult for retailers to protect their profits. Returns fraud alone cost the retail industry $101 billion in 2023, with bad actors finding numerous ways to go about it.

Six methods of return fraud reported in 2023:

- Wardrobing, or returning used and non-defective merchandise

- Returning shoplifted/stolen merchandise

- Returning merchandise purchased on fraudulent cards or returning counterfeit products

- Employee returns fraud or collusion

- ORC returns fraud

- Returns made with altered e-receipts

- Empty box

- Item not received (INR)

With so many avenues for returns fraud, it’s critical for fraud prevention and profit protection that retailers holistically understand each shopper’s behavior, beyond just the binary “good customer returns” and “bad customer returns.”

Defining “good” and “bad” customers

Traditionally, retailers approach returns fraud by categorizing consumers as “good” or “bad.” They use these binary groups to determine returns policies and outreach. Unfortunately, this oversimplification leaves retailers vulnerable to misunderstanding more nuanced behaviors and puts them at risk of misidentifying valuable good customer returns as fraudulent and vice versa. As a result, retailers might lose revenue and important consumer relationships while letting bad customer returns go unnoticed.

Analyzing consumer returns behavior

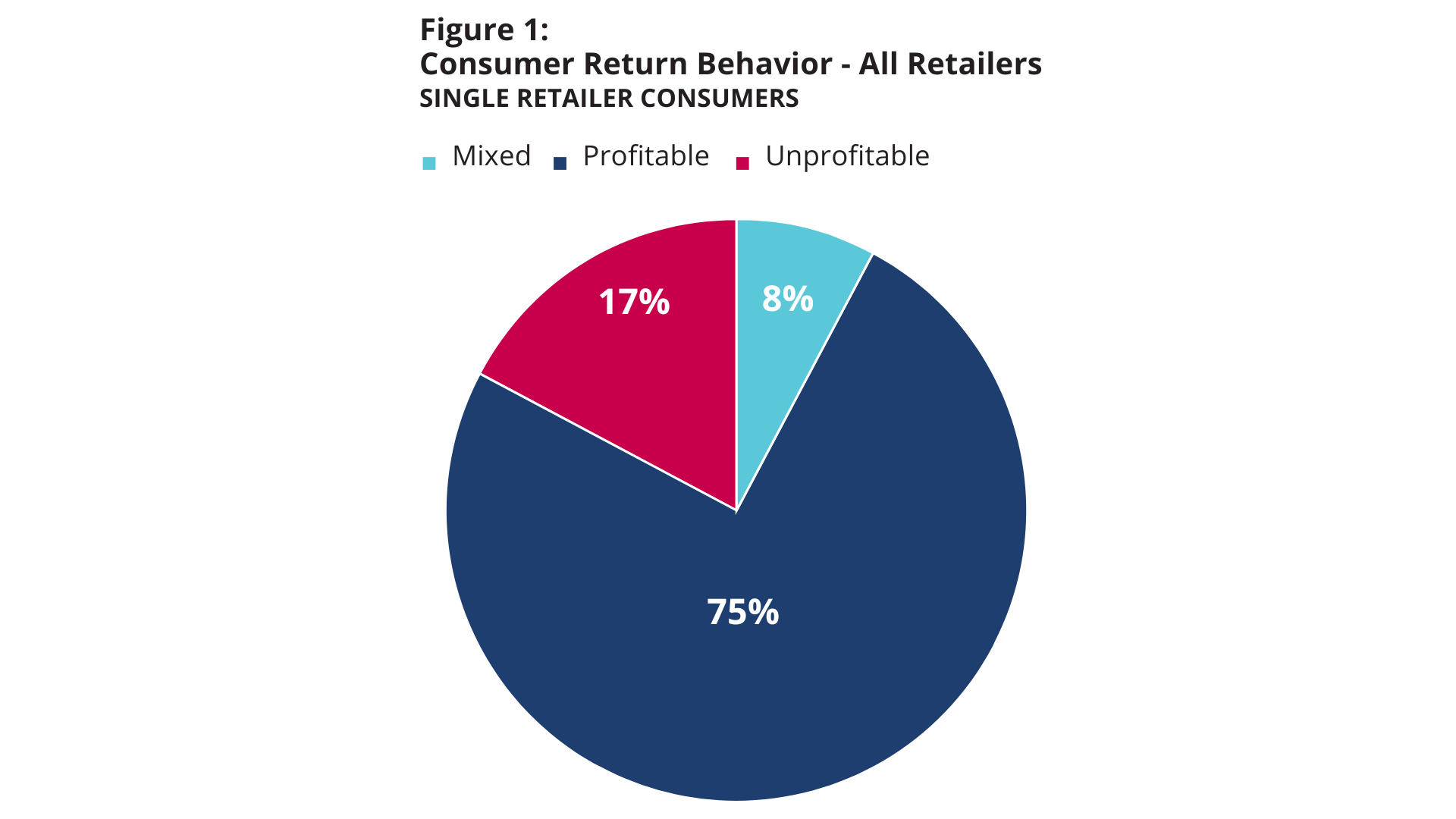

Recently, Appriss® Retail conducted a study designed to showcase why oversimplifying fraud prevention based on “good” and “bad” customers is dangerous. The study reviewed shopping and return behavior from 20 major retailers across four verticals: drug/pharmacy, auto parts, DIY, and apparel/footwear. Shoppers were categorized as “profitable,” “mixed,” or “unprofitable” based on their returns behavior. During this initial phase of research, 75% of consumers demonstrated good returns behavior across all retailers and verticals, whereas 8% of consumers showed mixed behavior, and 17% consistently demonstrated bad returns behavior.

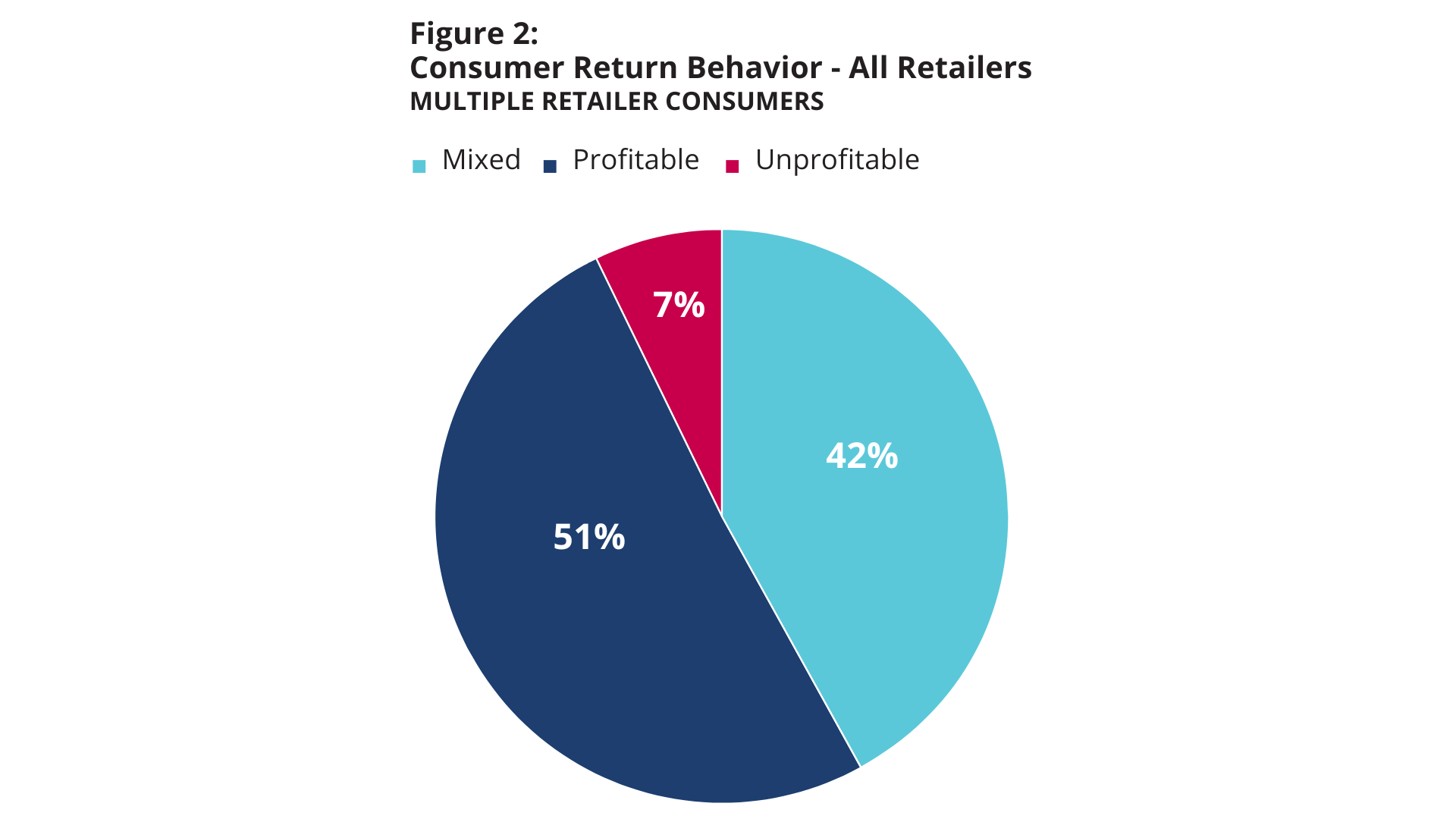

Next, the study considered only consumers who made returns across multiple retailers within the research pool. In this scenario, only 51% of consumers were consistently profitable across multiple retailers while 42% demonstrated mixed behavior and 7% were unprofitable.

By segmenting out which consumers made returns at two or more retailers, the nuance between “good” and “bad” is evident, showcasing why authorization decisions cannot rely solely on information from other retailers without skillful behavioral analysis.

Comparing consumer behavior across retail verticals

For the next analysis within the report, researchers considered whether return patterns were consistent across verticals. The study found that 69% of consumers who were profitable in one vertical were also profitable in at least two or more other verticals. Fourteen percent of consumers who made purchases and returns across verticals fell into the “mixed” category, complicating fraud prevention efforts for retailers. For example, a shopper may only make necessary returns at auto parts stores, but they might be caught frequently wardrobing from apparel retailers.

Without recognizing this nuance, the auto parts retailer might classify this customer as “bad” due to their cross-retailer behavior. This misjudgment could result in denying a return from an otherwise good consumer, thus adversely affecting the relationship and potential future purchases.

Real-world evidence: Insights from the apparel industry

Furthermore, in the competitive apparel retail industry, consumers often shop and return with multiple retailers, displaying different behaviors at each. Appriss Retail compared the way one consumer interacted with five apparel retailers. The consumer demonstrated good customer returns at two retailers, bad customer returns at another two, and mixed behavior at the last.

These results prompted additional questioning, such as:

- Does the consumer display different behavior online versus in-store?

- Can the consumer’s behavior be remedied with outreach or education regarding store policies?

This example proves why the binary of “good” and “bad” shoppers should be avoided in favor of a more nuanced approach to fraud detection with AI.

Leveraging AI to navigate the nuances between good customer returns and bad customer returns

Using AI, retailers can better understand customer behavior and implement flexible return policies that maintain beneficial relationships while protecting profits. For example, Engage, Appriss Retail’s AI-driven return authorization system, relies on predictive analytics and statistical models to prevent return fraud.

The solution considers an individual’s behavior and determines what policies to offer. High-value customers can earn flexible policies with extended returns windows. Yet, if their behavior becomes mixed, the solution automatically recommends a more limited policy to reduce risk.

AI helps provide retailers the security of knowing each customer will receive the returns policies they deserve.

Adopting a nuanced approach to consumer returns

Retailers must understand nuanced consumer behavior to effectively mitigate fraud and protect profits. Fortunately, Appriss Retail can help retailers leverage behavioral insights and AI to optimize fraud prevention.