OUR PARTNERS

360° protection to outsmart fraud.

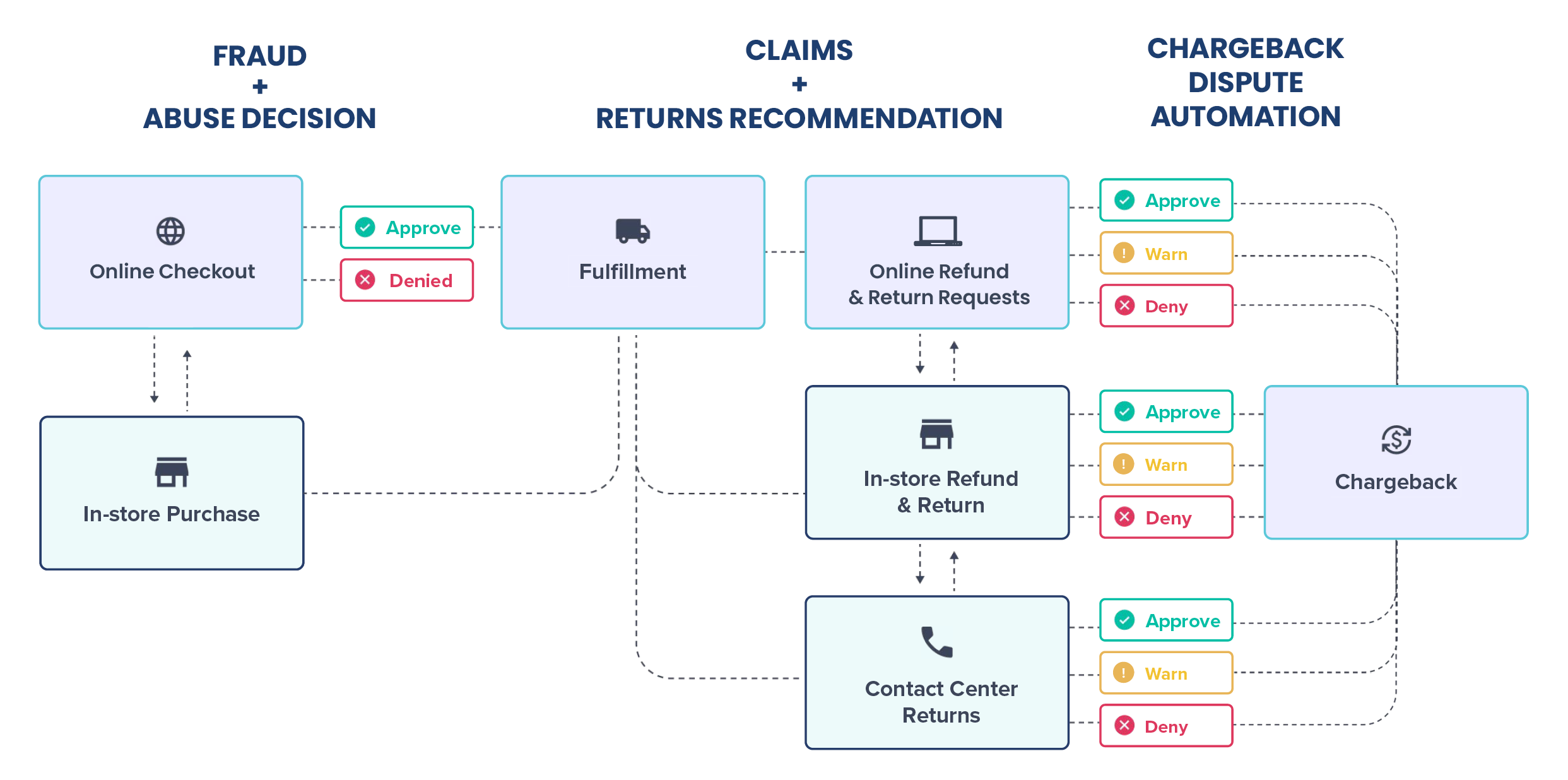

Retailers face a fragmented customer journey across checkout, returns, claims, support interactions, and chargeback disputes. Each touchpoint generates isolated data, making it nearly impossible to detect patterns of fraud and abuse. This lack of a unified view leaves retailers struggling to identify risky behaviors and vulnerable to exploitation.

Appriss Retail and Riskified have joined forces to bring you a 360° fraud and abuse prevention solution across the entire customer journey. Policy abuse and returns fraud cost merchants billions annually. That’s why Appriss Retail and Riskified have partnered to create a powerful, unified solution.

Interested in an omnichannel approach to stopping fraud? Let's chat!

Better together

Clear, precise decisions

Improved profitability

Advanced omnichannel risk insights

How it works

Gain a 360° view of shopper behavior

Appriss Retail harnesses machine learning to uncover the true identity behind shopper accounts by analyzing diverse data points across all transactions—whether in-store or online. This unified view of customer behavior helps businesses recognize trustworthy customers and flag fraud or abuse early.

Network-wide risk recognition

Using global merchant data and advanced models, our technology uncovers hidden connections across channels. Appriss’ Linking System integrates purchases, returns, claims, credit cards, and more, while Riskified’s ML engine evaluates 50+ data points and millions of transactions to deliver precise recommendations.

Automated and actionable intelligence

Together, we cover every stage of the customer journey—from checkout to claims and chargeback disputes—across all channels. We reduce friction for loyal customers, stop fraud and abuse, and protect profits at every touchpoint. The result? Higher approval rates, lower fraud losses, and stronger margins.

Learn more about Appriss Retail

The Bottom Line: How Returns and Claims Fraud Drive Total Retail Loss

Returns and claims abuse is quietly becoming one of the biggest threats to retail profitability—costing over $100B annually. This guide exposes the biggest sources of loss and shows how today’s smartest retailers are fighting back with AI, cross-functional teams, and frictionless fraud prevention.

Appriss Retail x Riskified Partner Overview

Discover how Appriss Retail and Riskified have partnered together to help retailers safeguard revenue, boost efficiency, and build customer loyalty.