Engage Claims and Appeasements Authorization

AI and data-driven recommendations that minimize fraudulent Did Not Arrive and Item Not Received claims.

Ecommerce has exploded, and while the growth is a boon to retailers, it has also opened new worlds of opportunity for fraud. In particular, false Did Not Arrive (DNA) and Item not Received (INR) claims cost retailers millions of dollars of profit loss every year. In some instances, these losses have exceeded ecommerce fraud chargebacks for retailers.

Validating DNA and INR claims puts an undue burden on your teammates. Fraudsters have set up elaborate schemes that make it virtually impossible for your teammates to identify which individual claims are legitimate and which ones are fraudulent while achieving the main goal of keeping legitimate consumers happy and not putting up barriers for good customers.

Use AI and data analytics to reward valued consumers and deter fraudsters.

identify patterns and trends

Use AI to link transaction identifiers across all your online and in-store orders to find consumers who are trying to hide their identity.

improve your bottom line

Realize significant annual savings by stopping fraudulent customer appeasements or reshipments for fraudulent claims.

set thresholds

Provide customer service agents with data-driven guidance to determine eligibility for an appeasement or reshipment.

reduce friction

Grant your valuable consumers who have legitimate claims the generous appeasements they deserve.

reduce fraudulent activity

Send clear message to fraudsters that your company is not an easy target for fraudulent DNA and IRA claims.

build brand loyalty

Enhance your reputation as a retailer that takes care of its customers.

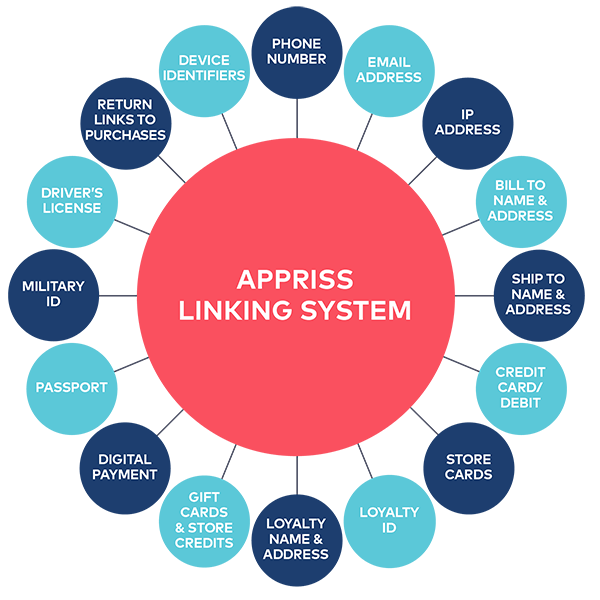

Appriss Linking System connects the dots within your data.

Applying artificial intelligence and advanced data models across all your transactions, Engage identifies customers who frequently change elements of their identity (email, bill to address, ship to address, phone number, loyalty information, etc.) in an attempt to “trick” legacy systems. A connection is flagged whenever an anomaly appears on the same transaction or connected transactions.

Engage then flags the customer’s account(s) to give your employees or automated systems recommendations to approve, warn, or deny a return based on guidelines defined by your company. The result: Profit dollars directly back on your bottom line.

Other types of fraud or abuse:

In addition to claims fraud, Appriss® Engage can help minimize the losses from many other types of consumer fraud or abuse, including friendly abuse scenarios.

Empty box return

Consumer makes a return. Retailer receives an empty box, or the item in the box is not what was originally purchased.

price arbitrage

Purchase made in-store or online at a discount and then returned for full price.

damaged item

Consumer claims the item was damaged upon receipt, securing a reshipment without return.

rental or wardrobing

Consumer repeatedly orders items online, uses and then returns the items.

reselling

Bulk purchases are made either in-store or online at deeply discounted prices, but then unsold items are returned when not resold.

credit laundering

Consumer uses a combination of gift cards, store credit and credit cards to purchase online, then returns all items claiming the full refund to the credit card.